1 Summary

In this note we discuss key risks for investors in 2025 and potential portfolio impacts. Looking forward, fiscal dominates economies with the US leading on spending and tax cuts. Relative fiscal impulse by country matters, with large spenders setting the stage for relative weakness in bonds, strong FX, and equity support in the short run. Bond volatility stays elevated in 2025 with rates leading asset classes as the market oscillates between recession and inflationary growth creating opportunities to reenter investments benefitting from the fiscal impulse.

2 Fiscal Stimulus1

Fiscal stimulus is the key macro variable to understand this cycle. Fiscal policy, particularly tax cuts, have a direct impact on economies as spending rises, supports incomes and is inflationary. The start of rising inflation in the US coincided with the first round of tax cuts passed by the Republican majority in 2017 2 . This fiscal stimulus happened in a strong economy3 . The inflationary impulse was supercharged by COVID and the freezing of supply chains as economies shut down. The Democrats continued spending post their 2020 election win, running deficits around 5-6% of GDP. Outside of wartime spending the size of the fiscal impulse in the US is a new development.

Fiscal policy is inflationary, stimulates growth and increases macroeconomic volatility. How much of US outperformance versus other countries is the result of fiscal largesse? We suspect a significant amount. Currently, US equities trade at 75-year highs versus equities ex-US. Countries in the G7 ex-US now project increases in fiscal spending, copying the US playbook and trying to narrow the fiscal gap. The short-term benefits of fiscal spending are too seductive for politicians. Recent snap elections in Germany were triggered by a dispute over spending increases4. Investors need to carefully watch fiscal impulses by country and consider the impact relative to discounted pricing.

3 Expect Higher Macroeconomic Volatility

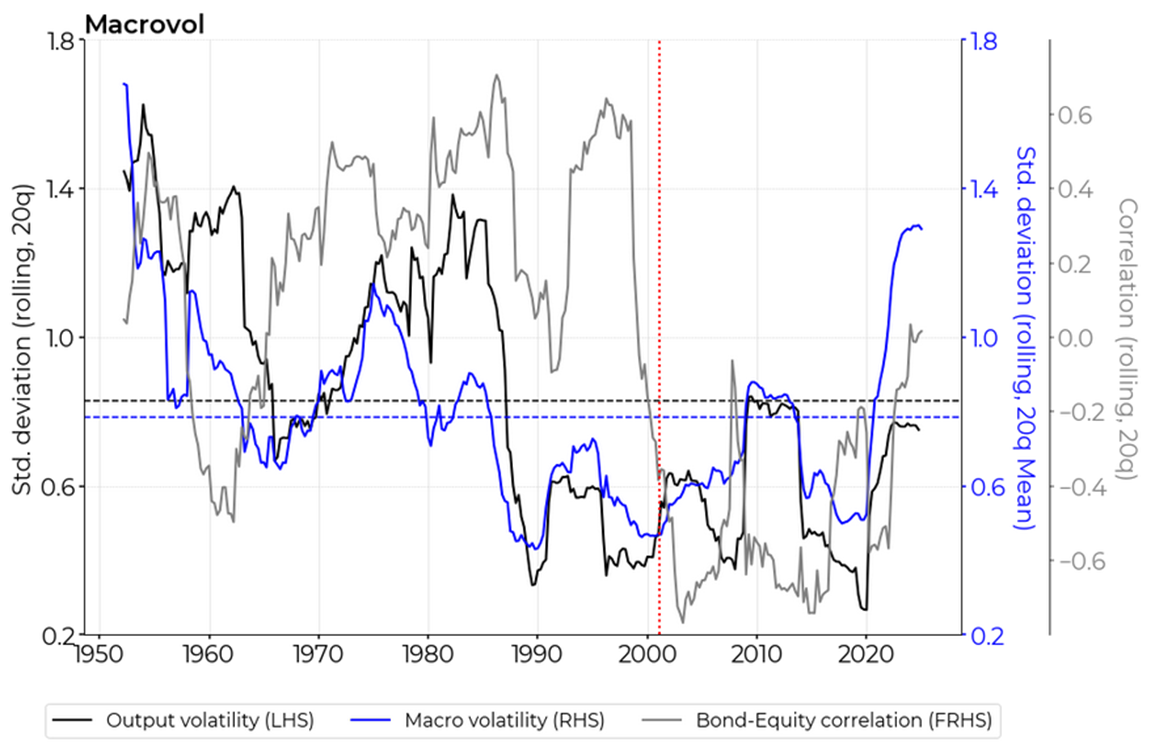

In the plot we show the reproduced and extended results from the seminal paper of Olivier Blanchard and John Simon entitled ‘The Long and Large Decline in US Output Volatility’. Written in 2001, they measured the standard deviation of US GDP since 1947 which showed a non-continuous reduction in output volatility5 up until the mid-1980s (the series in black). The vertical line in red is when the paper was published, with our extension – following their exact methodology thereafter. A year after their paper, Harvard economist James Stock and Mark Watson of Princeton coined the term the ‘Great Moderation’ to describe this phenomenon.

In order to check for robustness and universality, we extended their approach by using monthly data of various other macroeconomic variables, not only for the US, but from G7 nations and overlaid onto the Blanchard series (the blue line). We observe a non-trivial correlation and equivalent direction. Finally, we overlay the correlation between bonds and equities (the S&P 500 total return and US 10-year treasury total return, the grey line). The bond-equity correlation6 moved by and large in step with macroeconomic volatility. The implication is higher macroeconomic volatility leads to less diversification in the classical bond-equity asset allocation favored by investors.

There are various theories that have been posited for the reduction in macroeconomic volatility towards the Great Moderation (and beyond):

1. Technological advances that improved inventory and supply chain management.

2. Deregulation of many industries (including finance) that accelerated post-Carter.

3. Transition towards services away from manufacturing .

4. Increased sophistication of financial markets that improved capital allocation.

5. Ever more sophisticated theories of monetary and fiscal policy, including greater Central Bank independence since the 1980s – with monetary authorities being able to anchor inflation and inflation expectations.

6. Growth of global trade, and increased globalization.

7. ‘Stable’ geopolitics, which reduced the number of exogenous shocks.

8. Less worker power, of course related to increased globalization, which fostered more price stability.

Looking at this list, it is very conceivable that many of these elements will be less dominant or obvious going forward. Moreover, there are additional structural, and policy shifts underway:

1. More geopolitical friction. We have already had a taste of this. And the incoming US Administration is likely to be geopolitically hawkish. This is likely to lead to more volatile foreign exchange and commodity prices, more exogenous shocks, and more inward-looking policies as countries favor increased onshoring and friendshoring.

2. A less export-driven Chinese economy, which exported deflation for decades. The US adding yet unknown tariffs on China, and elsewhere, is, for the base case, likely to be inflationary.

3. Demographic shifts are likely to affect labor and labor productivity and likely the fiscus of many countries.

4. There are also strong arguments to be made for a greater race for resources, especially owing to the green transitions but also for food security which historically have often been a catalyst for civil unrest. This scrap for resources could also very well keep inflation elevated.

5. Central banks may be willing to tolerate higher levels of inflation.

Investors may have become too complacent with very low levels of macroeconomic volatility. And we already had a taste of what higher macro volatility could mean during Covid. The last time the US ran a large fiscal impulse with strong wage expansion was in the 1960s, an era of significantly higher macroeconomic volatility. The world has changed significantly since the 1950s and institutional frameworks have evolved but we expect the rapid acceptance of fiscal stimulus by the world’s large economies to drive macroeconomic volatility higher.

4 Republican Win – What is actionable?

The key risk for investors in 2025 is the impact of the Republican platform on markets. Investors need to differentiate between actionable platform promises post inauguration and promises that are hard to keep. With control of both Houses, the Republicans are in a strong position to pass many aspects of their platform, but investors should expect negotiations and pushback on contentious issues and ideas.

4.1. Tax Cuts

The Tax Cuts and Jobs Act (“TCJA”) passed by the Republican majority in 2017 expires at the end of 2025. The TCJA fundamentally changed the US tax code cutting corporate tax rates from 35% to 21% and cutting individual taxes. This fiscal stimulus was pro-cyclical, adding stimulus to a strong US economy.

Spending and taxes go through Congress. With control of both Houses we expect baseline Republican tax promises to pass. President-elect Trump (“Trump”) campaigned on corporate tax cuts from 21% to 15% and extending individual tax cuts. This adds $500bn to the deficit or 2% of GDP 7 .

Trump has also promised to exempt taxation of social security, taxes on tips, veterans, police officers & fire fighters, and serving military personnel. These tax items will be negotiated in Congress, but it is unclear whether they will pass. Deeper tax cuts add stimulation to the economy and worsen the fiscal picture. The Republican majority in the House is narrower than 2016 with a subset of Republicans that still support smaller deficits and fiscal austerity. Trump will negotiate8 with these constituencies to pass larger tax cuts.

Trump also believes tax cuts are an efficient form of fiscal stimulus as the boost to growth more than offsets the increase in the deficit. Similar to a real estate investor that uses leverage, if the asset performs the risk of the asset declines over time as its value appreciates and growing cashflows reduce the cost of interest service. An economy is similar, cuts in taxation impact the real economy directly through spending channels and wages via multiplier effects on the economy. One person’s spending is another person’s income, as money velocity rises economies grow.

4.2. Tariffs

Trump has a strong belief that tariffs can substitute for taxation to fund widening fiscal deficits. He also believes higher tariffs will re-shore manufacturing to America. He often cites policies under President McKinley, who served in office from 1897 until his assassination in 1901. During this era there was no Federal taxation and no Federal Reserve. America funded itself partly by imposing tariffs on its trading partners. Tariffs and immigration go through the Presidency giving the President significant powers to set tariff and immigration policy.

4.3. Immigration

Trump has talked about declaring a national emergency on immigration and using the military to expedite deportations. Undocumented immigrants depress wages in labor intensive sectors including hospitality, farming, and small business. A reduction in undocumented immigrants will lead to wage pressure and inflation, particularly for goods & services produced by these segments of the US economy.

4.4. Deregulation

The Republican administration will move quickly post inauguration to place market friendly picks in various government departments and regulatory agencies. We can expect less oversight and rules for several sectors including technology, financials, and industrials. This reduces cost for businesses and will increase merger activity and deal making. For financials it means less regulatory requirements including capital requirements. This improve margins and profitability, but it also means more room for credit expansion and is a direct stimulus to the economy.

4.5. Portfolio Impacts

Tax Cuts: Republican aversion to taxation implies deeper tax cuts than priced. Extending the TCJA should pass relatively easily with high odds of deeper cuts. Tax cuts expand the deficit and support inflation via rising spending. Tax negotiations will happen late 2025 when the TCJA is set to expire.

Tariffs: Unilateral power via the Presidency to set tariffs immediately. We expect tariffs to increase quickly post inauguration with immediate impacts on several countries.

Immigration: Reducing undocumented immigration is inflationary.

The Republican majority will pass deeper tax cuts, impose higher tariffs, and reduce immigration. The combination of these policies with a Republican majority is a powerful stimulus. The fiscal picture deteriorates, on the order of 9-10% of GDP, inflation is firm or higher and growth rises via multipliers. This is not fully priced and is bullish equities via spending, less regulation, and lower taxes. It is bearish bonds and frontend interest rates and supportive of the USD.

5 Global Linkages

In a world with open economies and global trade, one country’s decisions affect other countries. This effect is acute when a country runs large internal imbalances. For example, China with its large manufacturing surplus which it exports around the world. The larger the relationship between countries and the larger the imbalances, one country ends-up ‘exporting’ its policies to the other. In other words, China exports its manufacturing policies to its largest trading partners, whether they want those policies or not10 . Why should China set manufacturing policy for America? China could address the situation by rebalancing its own economy, using its manufacturing surplus domestically to support consumption and reduce global imbalances. President Xi is not a fan of Western consumption, but large trade surpluses also allow for the accumulation of foreign assets, expanding the economic power and reach of countries with large international reserves. The Trump administration wants to change this dynamic, particularly for non-aligned countries.

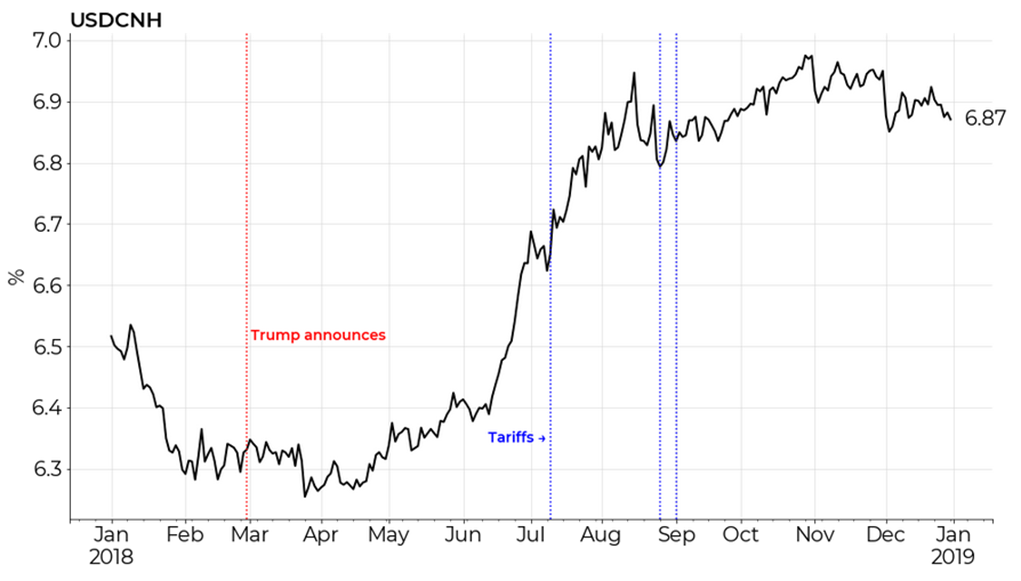

The Trump administration wants to reset the global trading order and reduce large imbalances. Part of the policy prescription is a combination of tariffs and incentives to make it attractive for foreign companies to relocate to America. How high can tariffs go? We believe higher than the market expects. Baseline tariffs on China will rise11 to 60%, 20% on allies and a 100% tariff on economies trying to de-dollarize. Trump’s USTR12 and Commerce Department picks13 support his ideas on tariff effectiveness. The President’s ability to impose tariffs quickly to extract desired behavior change will be used often and aggressively during his term. This is not fully priced. Shorting the FX of countries subject to ever rising tariffs is a clean expression14 of active tariff policy.

Ironically, an effective ‘tariff’ to close trade imbalances would be a tariff on global savings recycled to the US. We can think of the US as the world’s largest manufacturer of ‘safe’ assets to absorb the world’s savings. The tension here is between the real economy and the financial economy. A tariff on global savings reduces capital inflows and depresses the price of US financial assets which forces the US to either reduce consumption and / or increase domestic production, closing trade imbalances in the process. Unfortunately, this is a difficult proposition for financial sector profits, investors and Trump who pays attention to the strength of the stock market.

The US is the world’s largest economy but imports only account for 11.2%15 of GDP. In USD terms import amounts are large, but the US economy is less open than other large economies including Europe. The Trump administration will ‘export’ its trade policies to the rest of the world hurting economies more reliant on trade, particularly trade with China. For example, Japan and South Korea are hurt by China tariffs as they export intermediary goods to China for assembly. Understanding second order tariff effects is important for investors and will weigh on economies with deep linkages to the Chinese trading system.

6 Austerity?

The word ‘austerity’ is a forbidden word. We have to go all the way back to Bill Clinton’s second term to find a President that campaigned on austerity. He won. Clinton cut spending and increased taxes with fiscal deficits running at 4-5% of GDP. At one point, the CBO16 was projecting extinguishing the US debt over the next decade on large tax receipts from the technology stock boom and Government austerity. Times have changed. The incoming Republican administration will run fiscal deficits above 10%. There is a cost in the form of higher inflation and the willingness of private investors to fund rising fiscal deficits. In the future, it might be 6 months or 4 years, the market will demand a premium to fund ever expanding deficits. This pressure will be ever present for the bond market in the coming years. Investors should carefully watch bond auctions globally, looking for evidence of a private buyers strike. Politicians can’t get elected on tax hikes and spending cuts. The market will make the adjustment for the political class.

The Trump administration is establishing the DOGE17. Auditing government departments and understanding how money is spent is an important initiative. Spending cuts can be achieved but federal employment is roughly 1% of total employment in the US. Reducing federal headcount will not move the needle. Understanding how money is spent could. The GAO18estimates that $250-500bn of government spending is lost to fraud every year. Reducing these numbers could have a larger impact on the deficit. More accountability is positive, and we suspect several stories will come to light on inefficient spending and waste. Elon Musk has promised to cut $2tn in spending by the 4th of July 2026 but with the majority of the deficit coming from entitlements including social security and Medicare, defense where there is a bipartisan push to increase spending and finally interest payments which are crowding out spending could make it difficult to find $2tn in cuts. Interest payments are now larger than the defense budget. Cutting entitlements and defense are politically difficult and interest payments are subject to market forces.

7 Concentration19

Concentration and fiscal policy are two major risks heading into 2025. Concentration remains a feature of US equity indices. The narrowing of equity rallies tends to occur prior to bear markets but we have a large Republican stimulus as a tailwind. In the medium term the policy impulse dominates for equities and is supportive. In the longer term the fundamentals of large tech incumbents will matter. Software is highly scalable with marginal cost close to zero. AI is not. It requires large capex to build compute clusters with killer use cases remaining elusive. Eventually, the market will shift to focus on profitability, path to scale and spend projections. Pricing expectations are aggressive and companies that miss on these items will be punished. Foreigners hold over 50% of US equities, with the US stock market now representing over 50% of global equity market capitalization. The second largest contributor to global equity market capitalization is Japan at 6.3%. The world is overweight US equities, and the direction of the large US technology incumbents dictates the direction of the global equity risk premium.

8 Federal Reserve

What landing? Bond volatility is elevated for a reason. Going into the 2022 hiking cycle the market oscillated from recession, to soft landing, to no-landing. This continues to create attractive investment opportunities both outright and relative to other countries as investors overreact to data and reprice discounted economic outcomes. Investors should focus on the fiscal impulse and take advantage of dislocations.

Chairman Powell’s term will not be renewed in May 2026. In the interim, the Trump administration will pressure the Fed to cut rates. At the November 2024 Fed meeting Powell did not answer questions on potential Republican policies preferring to take a wait-and-see approach. Expanded fiscal policy is happening and the Fed will have to acknowledge this, implying tighter monetary policy for 2025. The Federal Reserve is a responsible central bank and will pivot to a tightening bias if financial conditions remain loose and inflation stays firm, the likely result of large fiscal stimulus.

9 Key Takeaways

- Fiscal spending increases with more countries pushing for fiscal expansion.

- The Republican sweep is a powerful combination of stimulus and de-regulation fueling animal spirits. Fiscal is not going away, it is rising. In the short run, stocks benefit, bonds selloff and USD strengthens. The larger the fiscal impulse, the larger the effect on asset prices.

- Tariffs will rise significantly and be more actively used than 2016. The Administration has a strong belief in their effectiveness to reduce trade imbalances and re-shore manufacturing to the US. Tariffs weaken the FX of targeted countries.

- China is exporting its trade policies to its largest trading partners by running large domestic imbalances. The Trump administration wants to reset the global trading order and reduce large imbalances.

- Tariffs will play a central role in rebalancing American trade relationships. The President’s ability to impose tariffs quickly to extract desired behavior change will be used often and aggressively during his term. This is not fully priced creating opportunities in equities, FX, and rates.

- Investors need to watch second order tariff effects. Countries like Japan and South Korea have large trading relationships with China and are collateral damage in a trade war.

- Fiscal largesse is inflationary and eventually, either via political action to reign in deficits or, more likely a large market adjustment, austerity will be implemented. Recall equities sold off as the 10-year Treasury reached 500-bps before the Fed’s pivot in late 2023.

- Investors should carefully watch bond auctions globally, looking for evidence of a private buyers strike.

- Concentration remains a large risk for equity markets. The narrowing of equity rallies tends to precede bear markets, but generous stimulus is dominating the short to medium term, extending the expansion and benefitting risk assets.

- Technology incumbents are at risk of underwhelming against high discounted expectations. AI is not software. It is expensive to build and requires large capex. The killer AI use case remains elusive while cost rise. With record levels of concentration and over 50% of global equity market capitalization accounted for by the US, the direction of global equities will be determined by America’s large technology incumbents.

- The Federal Reserve is too dovish. The Committee will recognize the impact of the Republican fiscal stimulus on growth and inflation and shift to a more hawkish tone.

- Rate volatility stays elevated with interest rates leading asset classes. The market will oscillate between recession, soft landing and inflationary growth creating many investment opportunities over 2025. Investors should stay focused on fiscal largesse as the dominant macro force.

DISCLAIMER

Any statements regarding market events, future events or other similar statements constitute only subjective views, are based upon expectations or beliefs, involve inherent risks and uncertainties and should therefore not be relied on. Future evidence and actual results could differ materially from those set forth, contemplated by or underlying these statements. In light of these risks and uncertainties, there can be no assurance that these statements are or will prove to be accurate or complete in any way. All opinions and estimates included in this document constitute judgments of CFM as at the date of this document and are subject to change without notice. CFM accepts no liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. CFM does not give any representation or warranty as to the reliability or accuracy of the information contained in this document. The information provided in this document is general information only and does not constitute investment or other advice. The content of this document does not constitute an offer or solicitation to subscribe for any security or interest.