Overview

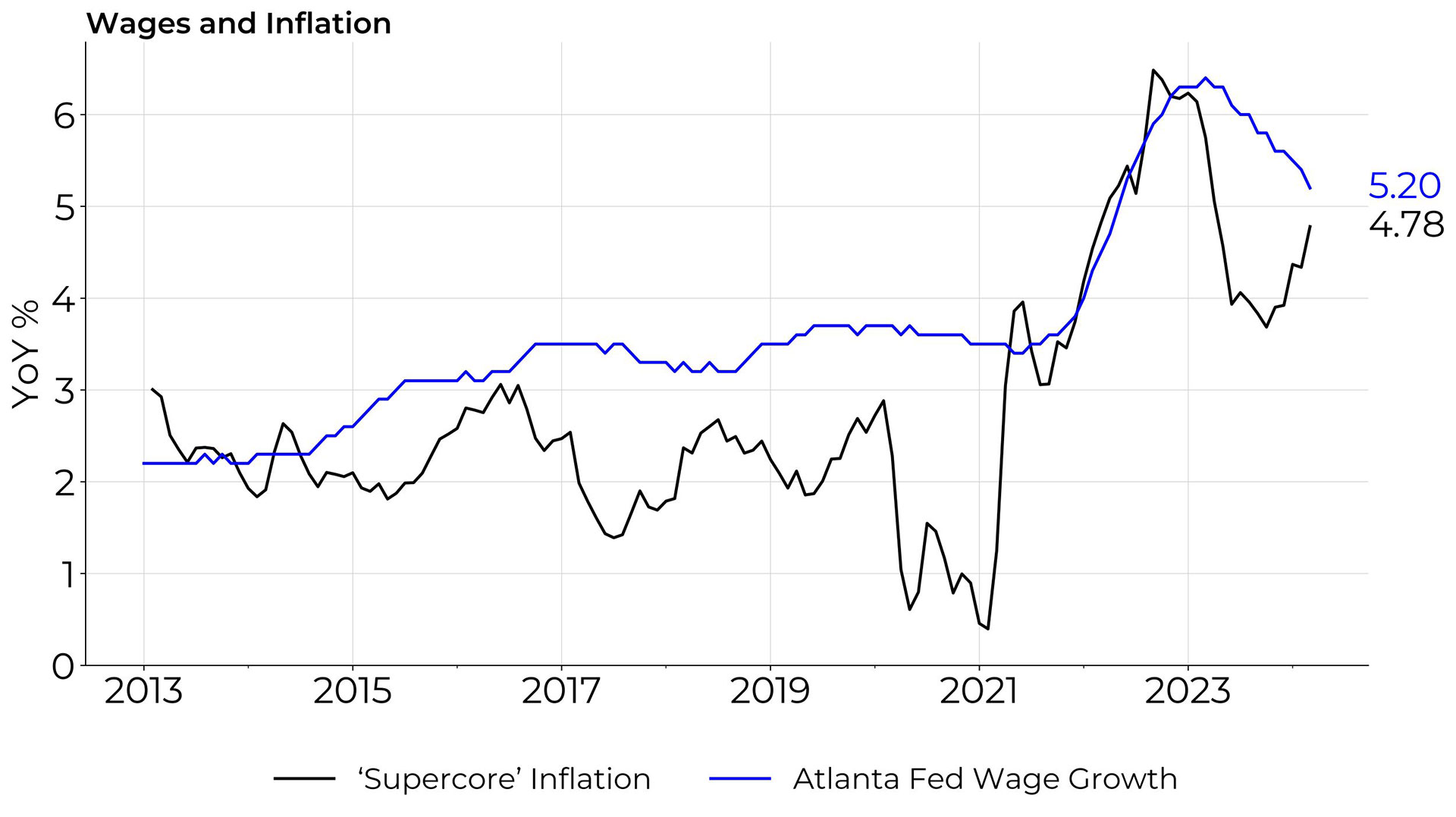

A major change this macro cycle versus prior ones is the emergence of a large, always-on fiscal policy impulse that stimulates an outperforming US economy. Irrespective of the party in power, the fiscal spigot has remained open. Trump started the trend with stimulative tax cuts and spending, and we then witnessed the unprecedented fiscal package during COVID – an arguably warranted response to the unknown consequences of shutting down a $25 trillion economy overnight. Politicians got a taste for big spending packages, setting the stage for fiscal addiction. Biden has continued with this fiscal largesse, further stimulating a US economy already running hot. This includes a secularly tight labor market with unemployment hovering around 3.8% and wages growing at 5.2% per year. Fiscal addiction increases macroeconomic volatility, makes inflation stickier and constrains the Fed’s ability to ease.

Does Fiscal Addiction have a Cost?

Inflation is the primary constraint, but not all stimulus is inflationary. There was a misconception during the Global Financial Crisis (GFC) that the Fed’s balance sheet expansion via Quantitative Easing (QE) would be inflationary. Inflation sensitive assets rallied, and many called for hyperinflation scenarios. QE, however, is not a new policy tool – the Fed used it for example during the Great Depression. Like the GFC, during the depression many believed hyperinflation was imminent and advocated for a return to a hard money standard. Inflation never materialized. Why? Money created in QE gets stuck in the banking system in the form of reserves and does not find its way directly into the real economy. There is a second order portfolio effect where QE reduces interest rates and pushes investors out the risk curve into riskier assets including equities. QE does not create inflation in the real economy, it only creates asset inflation. Fiscal is different. The money finds its way into the real economy and is spent, creating inflationary pressures. One irony of the GFC, if you had studied the great depression and positioned for the non-inflationary scenarios with a deeper understanding of QE, you would have lost money. To make money, you had to understand what the market believed, not reality. Eventually, when it became apparent QE was non-inflationary – just like the depression – asset prices moved in-line with fundamentals.

Fiscal is inflationary. Let’s look at two measures the Fed watches carefully: (i) wage growth; and (ii) services inflation. At 5.2% wage growth, real disposable incomes are rising, and services inflation has been surprising to the upside. More spending means more inflation. Services represent roughly 70% of the US economy and Supercore inflation, a proxy for services inflation, is running at 4.8%. Fiscal addiction keeps inflation elevated and makes it difficult for the Fed to achieve its policy objectives including anchoring inflation to its 2% target.

The Congressional Budget Office (CBO) projects a deficit of $1.6tn for 2024 or 6% of GDP. The projection for 2025 is $1.8tn. We are in an election year and the fiscal spigot is unlikely to get shut1. Below we show interest outlays as a percentage of GDP. Outlays are rising towards highs established in the 1990s. Bill Clinton was elected in 1991 partly on an austerity platform and promised to rein in spending. Interest outlays declined because of tax increases and reduced fiscal expenditures and there was a point towards the end of his tenure where the Treasury was having serious discussions about the US extinguishing its debt stock. That never happened. Now, in 2024, fiscal largesse prevails, and interest outlays are rising towards the uncomfortable levels of the 1990s. Eventually, the US will be pressured into spending cuts, including cutting entitlements, and enacting tax and growth reforms to put the budget back on a sustainable track. Rising inflation on the back of fiscal largesse will transmit to asset prices led by weakness in bond markets2 and eventually force an austerity program.

Takeaways

- Fiscal addiction increases macroeconomic volatility.

- Fiscal stimulus is spent in the real economy and is inflationary.

- QE is stuck in the banking system in the form of reserves and is non-inflationary.

- Always-on fiscal stimulus keeps inflation elevated.

- High inflation constrains the ability of Central Banks to stimulate.

- This leads to higher yields and elevated bond volatility

- As a result, yields are likely to lead other asset classes

- A higher yield environment is expected to weigh on equities and support the USD

1 Student loan forgiveness. CHIPS Act

2 “I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.” James Carville

Disclaimer

ANY DESCRIPTION OR INFORMATION INVOLVING MODELS, INVESTMENT PROCESSES OR ALLOCATIONS IS PROVIDED FOR ILLUSTRATIVE PURPOSES ONLY AND DOES NOT CONSTITUTE INVESTMENT ADVICE NOR AN OFFER OR SOLLICITATION TO SUBSCRIBE FOR ANY SECURITY OR INTEREST. ANY STATEMENTS REGARDING CORRELATIONS OR MODES OR OTHER SIMILAR BEHAVIORS CONSTITUTE ONLY SUBJECTIVE VIEWS, ARE BASED UPON REASONABLE EXPECTATIONS OR BELIEFS, AND SHOULD NOT BE RELIED ON. ALL STATEMENTS HEREIN ARE SUBJECT TO CHANGE DUE TO A VARIETY OF FACTORS INCLUDING FLUCTUATING MARKET CONDITIONS AND INVOLVE INHERENT RISKS AND UNCERTAINTIES BOTH GENERIC AND SPECIFIC, MANY OF WHICH CANNOT BE PREDICTED OR QUANTIFIED AND ARE BEYOND CFM’S CONTROL. FUTURE EVIDENCE AND ACTUAL RESULTS OR PERFORMANCE COULD DIFFER MATERIALLY FROM THE INFORMATION SET FORTH IN, CONTEMPLATED BY OR UNDERLYING THE STATEMENTS HEREIN. CFM ACCEPTS NO LIABILITY FOR ANY INACCURATE, INCOMPLETE OR OMITTED INFORMATION OF ANY KIND OR ANY LOSSES CAUSED BY USING THIS INFORMATION. CFM DOES NOT GIVE ANY REPRESENTATION OR WARRANTY AS TO THE RELIABILITY OR ACCURACY OF THE INFORMATION CONTAINED IN THIS DOCUMENT.