We had the recent pleasure of speaking over the phone – as the current situation dictates – with Stéphane Boujnah, CEO and Chairman of the Managing Board of Euronext. We discussed the recent market turmoil and how Euronext has navigated the surge in volatility and trading volumes; the role of the stock exchange in financing the real economy, as well as Euronext’s strategy and plans for the upcoming months.

CFM:

I believe it is only appropriate, given recent events, to pause for a moment and consider the turmoil in markets over the past month. What does an autopsy today reveal about recent volatility in the market and how the exchange managed the surge in volumes?

SB:

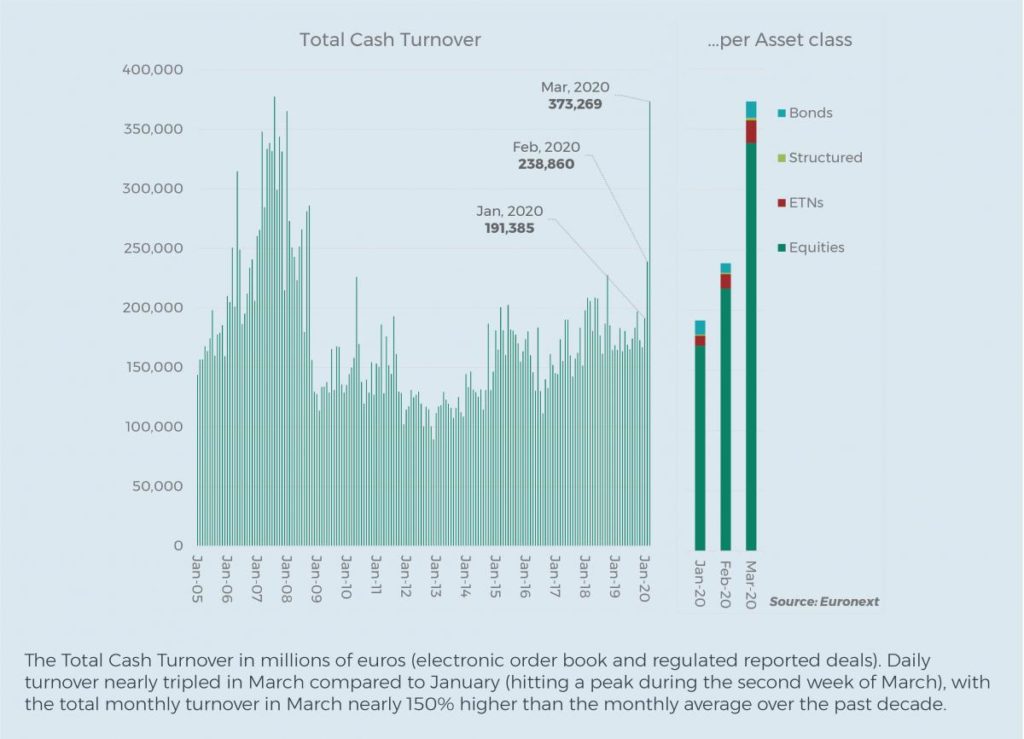

I think Euronext has shown that we can handle these moments of extreme volatility; and so far we passed the real-life stress test this crisis has imposed on us. We were able to cope with unprecedented volumes, without any glitches, and with 97% of employees working from home.

This is thanks to the substantial investment in technology we’ve made over the last four years, especially in Euronext’s new, in-house trading platform, Optiq®. This platform has proven to be resilient and fast, and also scalable and robust. Furthermore, our technology teams are all based in Europe, at close distance from operations teams, which means close coordination and access to quality digital infrastructure. This four-year investment has clearly demonstrated its value over the course of the past few weeks.

CFM:

Was any manual intervention necessary?

SB:

We had to extend, after consultation with regulators, the third reservation period to make the markets marginally more flexible. This extension of the reservation period for circuit breakers was implemented during the first days of the crisis when we saw the most extreme movements. Circuit breakers were activated, seamlessly and performed as they were designed to.

CFM:

There was at the same time a sprightly debate about whether or not to temporarily close markets. What was (is) the position of Euronext?

SB:

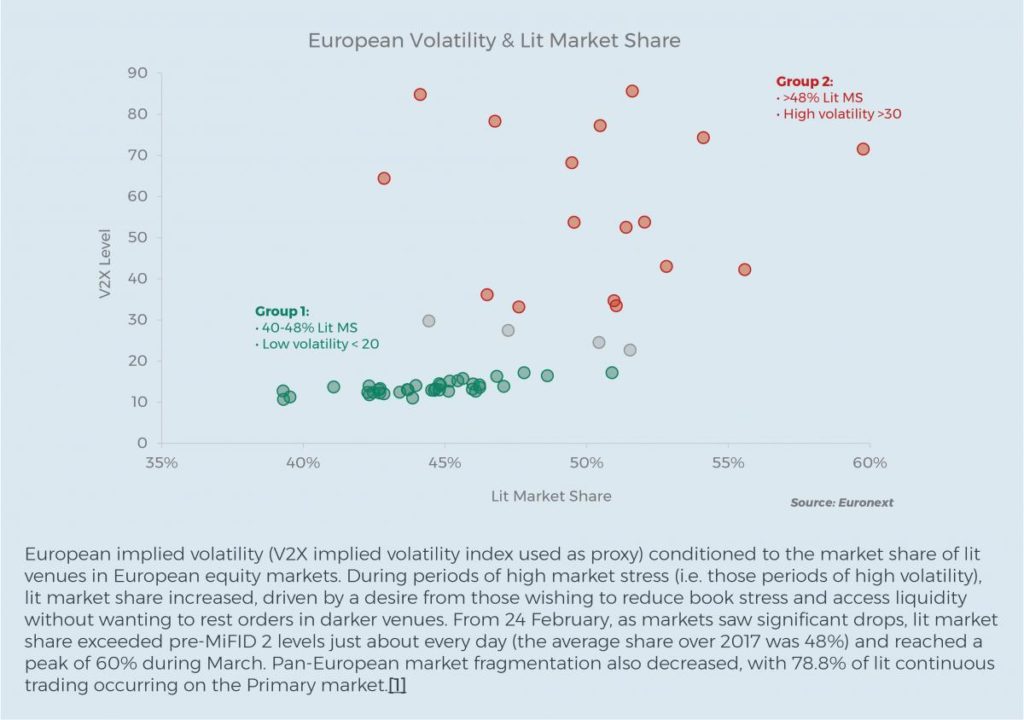

Markets must, and will remain open. There is a consensus between policy makers, regulators and market infrastructure operators on this matter. In the most extreme cases, and as it transpired, making adjustments to existing or already deployed measures is sufficient.

CFM:

What is your analysis of the effects of this health-crisis on the economy and markets?

SB:

This crisis is truly unprecedented. It is global, has taken place at nearly the same time everywhere, and its effects are being felt across every sector. This is very unusual. Other crises in the past have not had this level of convergence. However, while equity prices fell very sharply, we have to remember that the fundamental valuation of companies has not completely collapsed, as prices got back to levels seen in the course of 2016.

It is clear that this crisis has been characterised by an abundance of two distinct kinds of news flow. Firstly, the negative impact of the spread of Covid-19 on certain countries and continents around the world. For example, negative news about the rapid growth of cases in the US, with obvious economic consequences there. The uncertainties about the pace of penetration of the epidemic in India, where many technology centres critical to the operation of financial and industrial organisations are located. The pace of the spread in Africa, where healthcare infrastructure is less robust and with human consequences potentially more severe than elsewhere. Or even the impact of the epidemic in South America, where containment could severely affect the production of critical soft commodities. Secondly and conversely, positive news about the slow, yet encouraging recovery in China and Korea; tangible proof of the resilience of digital tools that allow for remote working; the magnitude and speed of deployment of government support, and of course, the actions taken by central banks and governments around the world.

Central banks have injected trillions of dollars and euros, while governments have injected hundreds of billions of taxpayers’ money, or, I should say, future generations’ money. We have seen, in four days, global central banks securing more liquidity than they did in four years during and after the GFC.

And, unlike during the GFC when there was political debate for 12-18 months about whether tax payer’s money should be used to save the banks, no such debate has taken place this time. There was no debate as to whether a Darwinian approach should have prevailed. Unlike the debate about supporting financial institutions during the financial crisis of 2008-2010, this time no one challenged the need for monetary and fiscal stimulus to support the real economy, allowing for the speed of intervention that we have seen.

All these elements have led to a rather quick stabilisation of markets, and we hope will lead to a swifter recovery of the economy.

CFM:

Another item that needs discussing, is the temporary ban on short-selling, which you supported. Was it right, despite critique and research demonstrating its ineffectiveness, to institute the ban?

SB:

Yes. During the first week or so of the crisis, when global indices suffered double digit losses day after day, many listed companies became nervous because short-selling was accelerating single-sided trade flow, amplifying the downward pricing trends. And also, regulators in many countries were convinced that some speculative investors were exploiting the trend, and extracting profit from the downward volatility, to the detriment of many issuers. Investors are fundamental users of market infrastructures, but issuers and companies are the raison d’être of any exchange. In normal market conditions, regulators and exchanges meet the needs of both investors and issuers. In these extreme market conditions, listed companies conveyed a clear message, supported by many regulators that certain financial instruments, like short-selling, do not contribute to proper price formation, do not contribute to proper information flow, and do not contribute to financing the real economy. In normal market conditions, short-selling is for sure a perfectly legitimate hedging and liquidity instrument, but in such extreme conditions, the compromise solution of a temporary ban on short-selling imposed by many regulators was the right one.

CFM:

Were you consulted by the French government and/or others before the decision was taken to institute the ban?

SB:

Yes. The debate on the short-selling ban was very transparent. And it was not an ideological debate, but a debate on how to find the right balance between the interests of issuers and investors. The goal of the regulators at the forefront of this process, was to implement ‘cooling down measures’. Among the measures was the request to activate slightly longer reservation periods – as I mentioned before, for the third reservation period – and the ban of short-selling. It was thought that these measures would maintain trust in the markets and keep the process between interested parties coordinated.

CFM:

Are you disappointed that there was no European aligned intervention in the market?

SB:

Yes, I would have preferred there to have been European alignment. However, some countries were not keen on banning short-selling for a variety of legitimate conceptual, theoretical and business reasons.

In any case, bans on short-selling have to be temporary – short-selling plays an important part in the normal operations of a market for hedging and liquidity provision. But given the confluence of an extreme downward risk environment, high volumes, and general negative news flow, it was an appropriate measure to introduce. So, while I was disappointed by the lack of a coordinated European response, the most important federal response came from the European Central Bank, which will be injecting billions of euros in the form of asset purchases.

CFM:

Given an eventual return to some normality, how, if at all, have recent events changed the outlook for capital raising via an exchange vs. via private markets?

SB:

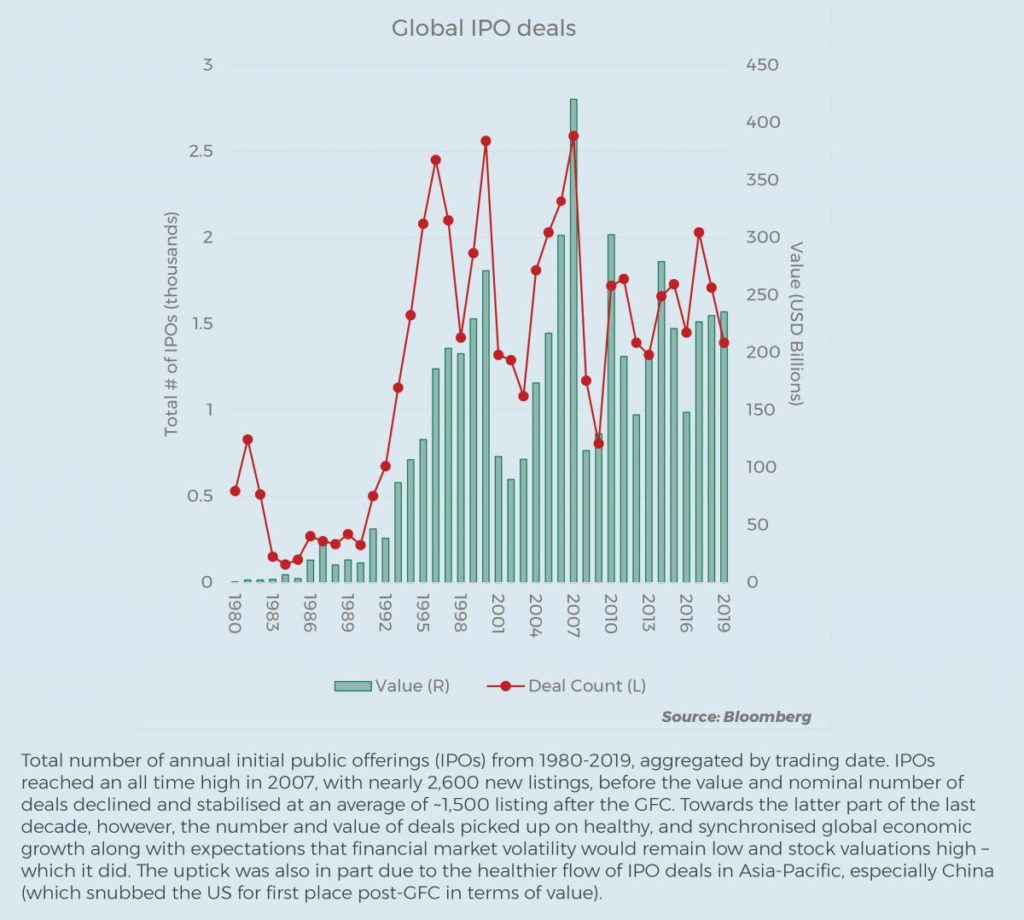

Listing, as you know, is pretty much frozen for the time being, but the effects of the last few weeks will also be felt also across the private equity industry. Funds that were and are relying on heavy debt leverage won’t be available to do so in the same volume or at the same multiples as of a few weeks ago. Debt financing was also available at a very low cost. Banks today are injecting liquidity to generate short-to-medium term lending facilities, but what they can’t do much of, is pricing risk accurately and tightly given the uncertainty surrounding the global economic trajectory.

Public vs. private markets will probably be reweighted. I believe that the role of the exchange as a high-quality transparent venue to raise capital and find liquidity is going to be more critical as private markets will probably have to adjust to deteriorated access to leverage.

Furthermore, certain private equity funds might have to look for liquidity in the markets if they cannot access it through a trade sale – which in and of itself now looks more challenging than it was a few months ago. But, for the moment, it is too early to tell whether private equity funds will return to IPOs quickly as valuations have been hurt. To me it is clear that, while IPOs may be on hold for a while, companies are likely to look at the IPO option more favourably than they have been in the recent past.

CFM:

The acquisition of Refinitiv by the London Stock Exchange underscores one of the main trends of business diversification for exchanges, i.e. the commoditisation of market data. How do you plan to position Euronext in this data arms race?

SB:

One of our two core strategic ambitions at Euronext is to diversify our revenue stream to make it less reliant on equity volume-driven business. In this respect, we will continue to pursue the kind of investments needed for diversification that we have been making. Many are surprised to hear that only 40% of our top-line is linked to volumes – when I joined in 2015, this figure was closer to 60%.

Not only have we substantially reduced Euronext’s dependence on equity volume-driven revenues, but we have also invested in different asset classes. For example, we invested in Nordpool, the power exchange[2], which while a volume business, is completely uncorrelated to equity markets. We also, in 2017, invested in FastMatch – a forex platform, now called Euronext FX; and in 2018 we acquired the Irish Stock Exchange – where 80% of revenue is generated from listing bonds. Another milestone and significant investment was the acquisition of Oslo Børs VPS in 2019, which included a significant CSD (central securities depository) business. And we are determined to continue diversifying the Euronext revenues, notably in the post-trade and market data areas of the market infrastructure value chain.

CFM:

You also took a stake in ‘Tokeny Solutions’, the Luxembourg based financial asset tokenisation business. What are your expectations for this technology and its applications?

SB:

We have taken a minority stake as we believe tokenisation of assets is a significant trend. With this strategic investment we were able to accelerate our know-how and capacity in this technology by outsourcing R&D and product development in a quality firm, with a first class team and management. In the world of blockchain technology, with a huge array of distinct and differentiated projects and initiatives, Tokeny is probably the one that offers the most shortcuts to directly connecting blockchain with market-driven applications.

CFM:

Responsible/ESG investment is another contemporary topic that has been enjoying immense growth and attention. How do you think this crisis will impact this trend?

SB:

Even before the current crisis, the importance of ESG was growing everywhere. You might remember, on the 14th of January earlier this year, BlackRock announced that sustainability should be their new standard for investing. A few days earlier, Amundi – the largest asset manager in Europe – announced a similar commitment, with plans to integrate ESG investment criteria into all their open-ended funds by 2021.

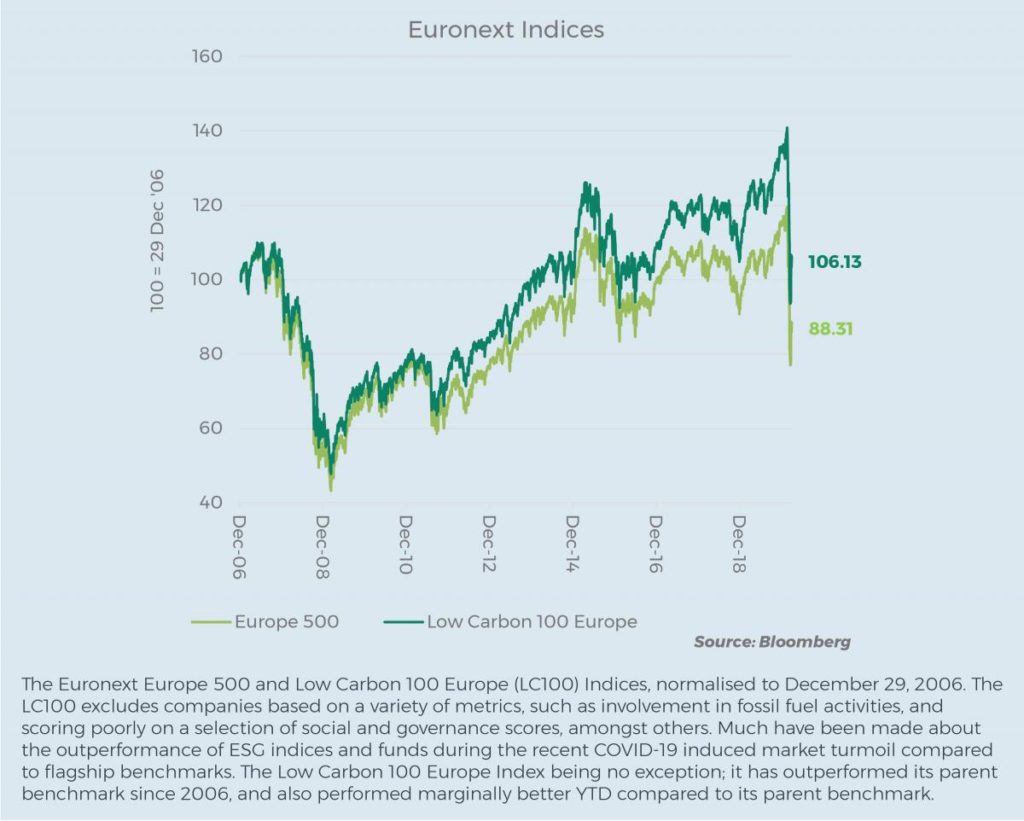

Even as far back as 2018, about 50% of all our new indices were ESG indices. This jumped to above 80% in 2019. Crises very rarely invent new things, but crises very often accelerate new things. The growth of ESG is a profound trend and the Covid-19 crisis will only hasten its prevalence. In my view, ESG will come more and more into the mainstream as we move forward through this crisis.

CFM:

In this move of ESG towards the mainstream, what role should Euronext and Europe play?

SB:

We, as an exchange, have taken the initiative by coordinating with other European exchanges and listing venues to prepare a common ESG guide for all the listed companies in Europe, so that issuers can follow the same set of guidelines on ESG measurement and reporting.[3] In Europe, a standardisation process is ongoing, with the European Commission establishing an ESG taxonomy. Europe will not only be a territory of ESG takers, but is being proactive in becoming a continent of ESG makers. No one wants to be in a paradox where the decisions of 450 million Europeans, hundreds of blue-chip companies with global reach, and one of the largest pools of savings in the planet are all driven by ESG, but, the so to speak “new ESG accounting language” is imposed on the EU from outside.

The ambition, in which Euronext will play its part, is to make sure that the EU can build for ESG what it has built for telecoms thirty years ago, when it developed and introduced the GSM standards that prevail to this day.

Europe has the largest pool of ESG investors, the largest pool of ESG compliant issuers, the largest pace of adoption of ESG investment, and is largely ahead of the curve, especially as compared to the United States. Europe therefore needs its own ESG standards.

CFM:

You raise an important point, i.e. the broadly advanced stage of Europe in ESG adoption compared to especially the United States. Do you think this status quo will be challenged by the US?

SB:

The biggest mistake you can make is to treat the US as a homogenous entity. While the current administration appears unconvinced about this trend, various states and business interests take the opposite view. BlackRock for example, as we touched upon earlier, is a very influential US-domiciled firm that is taking a very public stance in favour of ESG. When I do roadshows across the US, the differences across states are stark, with hugely diverse approaches towards responsible investment. When I find myself on the West Coast, New York City, Boston or Chicago, the talk and adoption of ESG seems very much mainstream, while in some other states much less so.

There are even more nuances being created in the US, especially with downward pressure on oil prices: for some it is an opportunity to take advantage of cheap energy, delaying investment in renewable projects, while others argue delaying investment in renewables is counter to achieving climate goals. My suspicion is that the situation in the US will remain volatile and uncoordinated for a while.

CFM:

Do your expansion plans, and diversifying ambitions extend beyond the borders of Europe?

SB:

We have a clear view and strategy on our growth ambitions. As for expanding in terms of our core business, i.e. acquiring other exchanges and extracting synergies – the focus is Europe, where we are extremely effective in improving operational efficiency and extracting value. In 2013, when we were still owned by the NYSE, the EBITDA margin was 29%. In 2019, our EBITDA margin was very close to 60%. We have demonstrated that we can double the EBITDA margin of an exchange, while quadrupling the market cap, and doubling the topline. We have deep knowledge and experience in building in Europe a single liquidity pool, enabled by a single order book, powered by a single technology platform to run exchanges extremely efficiently. We will not be in the same position outside Europe, where exchanges cannot be connected to our federal model, and not be part of the single liquidity pool. As such, and for the time being, the appetite for acquiring exchanges outside Europe is more limited, because the synergies are not as evident.

That being said, when it comes to acquiring non-volume-driven businesses, we are absolutely agnostic about location. Our acquisition of FastMatch, now Euronext FX, is a good example. Most of the Euronext FX staff is based in New York and London, with an office in Singapore too, serving clients who are also mostly based in New York and London. We buy technologies, teams, and businesses wherever the talent is, wherever the business is.

CFM:

I believe it compulsory to then ask the question about the news that Euronext has dropped its bid for the Bolsa de Madrid (BME). Was the premium simply too steep?

SB:

From a strategic point of view, Spanish capital markets are part of the European Union, and Euronext could have been a natural partner to offer European solutions to Spanish companies and investors, within the Euronext federal model. We have analysed all the facts closely and all the parameters of the situation very carefully. Our assessment was that financial terms of a potential competing bid on BME would not have provided the level of return on invested capital that Euronext commits to deliver to our shareholders. The price offered by SIX incorporated an extreme premium that we could not justify paying given the underlying fundamental performance and trajectory of the business, the magnitude of the synergies that we would have been able to extract to make the Euronext single liquidity pool work, and the fact that the Spanish government approved the deal for SIX with the commitment not to make any material changes for a period of 10 years. We concluded that we could not justify outbidding in April 2020 an already extremely high price that was set in November 2019.

Euronext is convinced of the strong industrial benefits that a combination between BME and Euronext would bring to the Spanish capital markets and the wider European capital markets, in particular to build the backbone of the Capital Markets Union within the European Union. Under the SIX umbrella, BME will be coordinated with a third-party based in a country that is not part of the EU, potentially isolating Spanish markets. We think that our industrial value proposition is stronger, but we owe our shareholders discipline when we deploy their capital, and this time, the premium would just have been too extreme to deliver adequate returns.

CFM:

That serves as an appropriate segue into a final question, namely alignment across European exchanges, and especially regarding the formal consultation launched by the London Stock Exchange on the shortening of trading hours. What is the position of Euronext?

SB:

We are open to considering any initiative that could improve culture and diversity in the financial services industry. As a market operator, we are also responsible for maintaining fair and orderly markets. In assessing the proposal to review market trading hours, we must remain particularly vigilant of the impact that a change may have on market structure. At this stage, I am personally not convinced that shortening trading hours will make markets more efficient or more liquid. We are currently in the process of consulting with our clients and we will make a decision on whether there is a genuine and wide enough demand for a more formal process. If there isn’t, we will not proceed. Moreover, it is critical to preserve existing synchronization of market trading hours across Europe, so any change in trading hours will have to be coordinated with all our peers.

[1] Data from Morgan Stanley.

[2] As a power exchange, Nord Pool is the largest electricity market trading venue in Europe, providing investors access to trade electricity in 13 countries.

[3] Euronext has published a set of guidelines for issuers on ESG reporting. This document is available on the Euronext website: https://www.euronext.com/en/news/esg-guidelines-for-listed-companies

For more information on Euronext, please see their website: www.euronext.com

Mr Boujnah spoke with André Breedt, Research Associate in the Paris office of CFM.

DISCLAIMER

THE TEXT IS AN EDITED TRANSCRIPT OF A PHONE INTERVIEW WITH STÉPHANE BOUJNAH IN MARCH 2020. THE VIEWS AND OPINIONS EXPRESSED IN THIS INTERVIEW ARE THOSE OF STÉPHANE BOUJNAH AND MAY NOT NECESSARILY REFLECT THE OFFICIAL POLICY OR POSITION OF EITHER CFM OR ANY OF ITS AFFILIATES. THE INFORMATION PROVIDED HEREIN IS GENERAL INFORMATION ONLY AND DOES NOT CONSTITUTE INVESTMENT OR OTHER ADVICE. ANY STATEMENTS REGARDING MARKET EVENTS, FUTURE EVENTS OR OTHER SIMILAR STATEMENTS CONSTITUTE ONLY SUBJECTIVE VIEWS, ARE BASED UPON EXPECTATIONS OR BELIEFS, INVOLVE INHERENT RISKS AND UNCERTAINTIES AND SHOULD THEREFORE NOT BE RELIED ON. FUTURE EVIDENCE AND ACTUAL RESULTS COULD DIFFER MATERIALLY FROM THOSE SET FORTH, CONTEMPLATED BY OR UNDERLYING THESE STATEMENTS. IN LIGHT OF THESE RISKS AND UNCERTAINTIES, THERE CAN BE NO ASSURANCE THAT THESE STATEMENTS ARE OR WILL PROVE TO BE ACCURATE OR COMPLETE IN ANY WAY.