Causing a STIR: Why Short-Term Rate Forecasts Often Miss the Mark, And Why That Matters

Markets thrive on predictions. Central banks, analysts, and the financial media generate thousands of them, often with what looks like remarkable confidence. But if there’s one thing history has taught us, it’s that the collective wisdom of investors often turns out to be, well, not wisdom at all.

Nowhere is this more apparent than in short-term interest rate (STIR) markets, where futures and options reflect expectations of central bank policy. These instruments imply a consensus forecast on the future trend of rates: how many cuts or hikes are expected, and how probable these different scenarios are. Right now, the prevailing wisdom is that monetary easing is coming, especially in the US and the Eurozone.

But there’s a catch – market pricing of future rate paths is often unreliable. It represents the clearing price of a mix of informed and uninformed opinions, all influenced by macroeconomic expectations, positioning, and sentiment. And that creates opportunities for investors willing to go against the grain.

What Markets Are Pricing In (And Why A Little Scepticism Might Be Healthy)

As of now, STIR futures suggest the following for 2025:

• Federal Reserve (Fed): Just under two cuts

• Bank of England (BoE): Just over three cuts

• European Central Bank (ECB): Just over three cuts

Options markets largely support this view, with traders assigning a greater probability to rate cuts than hikes in the US and eurozone, while the UK outlook is in the balance.

That may sound reasonable, but historical precedent suggests caution. Rate expectations are highly reactive to incoming data, political developments, and central bank signalling – and they frequently over- or underestimate the magnitude of policy moves. Only the boldest investor would attempt to predict President Trump’s geopolitical or trade moves next week, never mind in six months’ time.

United States: Will Fiscal Stimulus Force the Fed’s Hand?

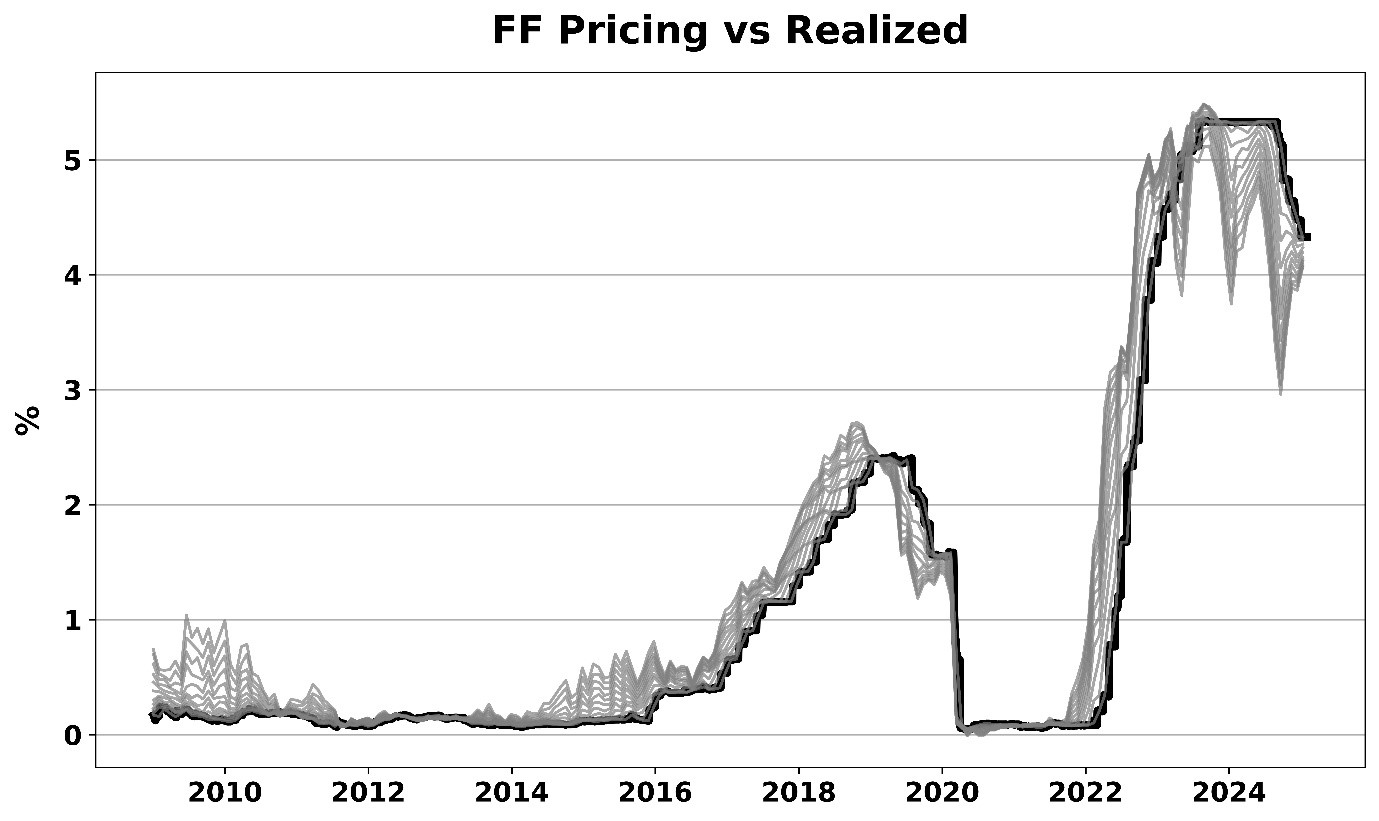

The Fed began easing in November 2023, but markets have struggled to price the trajectory accurately. At the start of 2024, traders were convinced the Fed would cut more than six times – a pace more in line with a severe recession than a stable economy. That expectation gradually evaporated as economic data remained robust and inflation remained stubbornly high.

Fast forward to today (February 2025), and markets have shifted their expectations, now discounting just 1.6 cuts in 2025. Meanwhile, the political landscape has shifted radically. The Republican victory in November has put growth firmly back on the menu through a smorgasbord of fiscal measures that include tax cuts, higher public spending, and deregulation. With fresh stimulus in the offing, rate cuts may not be as straightforward as markets expect. If inflationary pressures (including from trade wars, phoney or real) re-emerge, the Fed could be forced to reconsider its easing path – or perhaps even hike rates instead.

Options markets reflect this uncertainty. While the Secured Overnight Financing Rate (SOFR) market leans towards rate cuts, there is now a 1-in-3 probability of no cuts at all, and even a 1-in-5 chance of a rate hike. What this means is that markets may be not be fully pricing in the risk that US monetary policy could diverge from current forecasts.

Europe and The Limits of Monetary Policy

One question for investors to examine is the extent to which the US economy’s outperformance is due to its aggressive fiscal stance. Former Italian Prime Minister Mario Draghi’s recent report on Europe’s current economic woes included a call for fiscal expansion, but the EU operates under far stricter budgetary constraints and does not have the same ability as the US to stimulate demand through government spending.

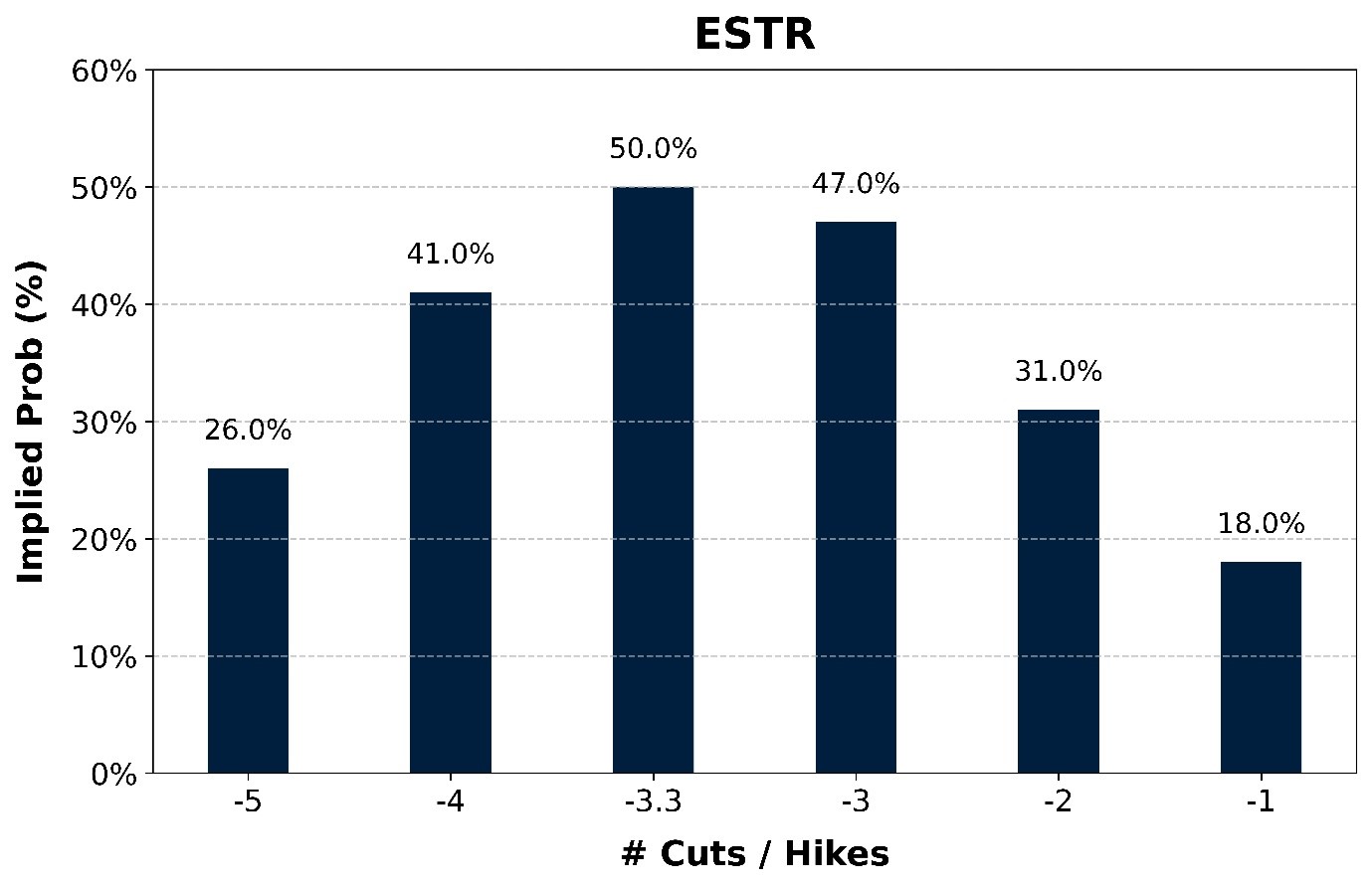

The Maastricht Treaty’s 3% deficit rule restricts how far European governments can go before triggering intervention, in stark contrast to the US, where the federal deficit is running at over 6% of GDP and is expected to expand further. This fiscal divergence is influencing monetary policy expectations – the ESTR market expects the ECB to cut rates just over three times in 2025, against a subdued inflationary backdrop and sluggish prospects for growth.

Options markets are in agreement, pricing in a one-in-four chance of five cuts and a one-in-five chance of just one. But while rate cuts seem warranted, the ECB’s ability to boost demand will remain constrained by Europe’s fragmented fiscal architecture. Without coordinated fiscal expansion, lower interest rates alone may not be enough to generate sustained growth.

United Kingdom: Post-Brexit, Post-Labour, Precarious

In glorious isolation (?) outside the eurozone, the UK faces fewer self-imposed fiscal constraints. However, it remains highly exposed to global capital flows, meaning market sentiment plays a crucial role in shaping its borrowing costs.

Following Labour’s electoral victory on a redistributive economic manifesto, investors reacted by selling UK government bonds and the pound, the kind of reaction that is more typically seen in emerging markets, where concerns about fiscal discipline and capital flight weigh on investor confidence.

Moreover, the UK rate outlook is highly correlated with US monetary policy. Recent rises in US Treasury yields have contributed to a broader sell-off in UK gilts, worsening the country’s fiscal position and restricting Labour’s already limited room for maneouvre.

The Sterling Overnight Index Average (SONIA) market currently expects the Bank of Enlgand to cut rates over three times in 2025, but options pricing suggests a broadly symmetrical distribution of risks – with nearly equal probabilities given to either further cuts or potential hikes. This reflects the Bank’s stance, with a cautious MPC waiting to assess the impact of fiscal policy on inflation before making further cuts.

Investor takeaways

• The Fed, ECB, and BoE are all seen cutting rates in 2025, but how fast and how far remains uncertain.

• The new US administration’s fiscal policy represents an inflationary risk that may force the Fed to slow or reverse rate cuts.

• The ECB faces structural budgetary constraints – while rate cuts are likely, their impact may be limited in the absence of coordinated fiscal support.

• The UK’s monetary path is unpredictable, with markets pricing in a broader range of potential outcomes than for the US or eurozone.

Conclusion: Heed the Oracle?

Forecasts may tell you a great deal about the forecaster; they tell you nothing about the future — Warren Buffet.

The Oracle of Omaha may have been exaggerating, but not by much. Forecasts for interest rates often miss the mark. Market pricing is reactive, volatile, and influenced by short-term sentiment as much as fundamental economic conditions. For investors, this means opportunities to position against mispriced expectations – provided they can separate the signal from the noise.

Central banks may be preparing to cut rates – but how far and how fast remains an open question. And as always, markets will adjust their expectations accordingly – sometimes abruptly, and often incorrectly.

1 The Fed typically cuts or hikes in 25bp increments

2 Secured Overnight Financing Rate. As of February 5, 2025.

3 Unconditional Black-Scholes probabilities

4 https://commission.europa.eu/document/download/97e481fd-2dc3-412d-be4c-f152a8232961_en

5 The Tax Cuts and Jobs Act passed by the Republicans in 2017 fundamentally changed the US tax code

6 Euro Short Term Rate. As of February 5, 2025

7 The ECB typically cuts or hikes in 25bp increments

8 As of February 5, 2025

9 The BoE typically cuts or hikes in 25bp increments

DISCLAIMER

Any statements regarding market events, future events or other similar statements constitute only subjective views, are based upon expectations or beliefs, involve inherent risks and uncertainties and should therefore not be relied on. Future evidence and actual results could differ materially from those set forth, contemplated by or underlying these statements. In light of these risks and uncertainties, there can be no assurance that these statements are or will prove to be accurate or complete in any way. All opinions and estimates included in this document constitute judgments of CFM as at the date of this document and are subject to change without notice. CFM accepts no liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. CFM does not give any representation or warranty as to the reliability or accuracy of the information contained in this document. The information provided in this document is general information only and does not constitute investment or other advice. The content of this document does not constitute an offer or solicitation to subscribe for any security or interest.