We sat down with Ms. Fiona Reynolds, CEO of the United Nations Principles for Responsible Investment (PRI), to discuss a range of contemporary responsible investment topics, all vying to define the future of the investment industry. In their London offices, we talked about the remarkable growth of the PRI since its formation only a little more than a decade ago, to some of the greatest challenges facing investors and our planet alike. Driven in large part by asset owners who are becoming evermore demanding and discerning in how their managers should account for Environmental, Social, and Governance (ESG) information in the investment decision and allocation process, the concept of ESG investment is moving into the mainstream. Fiona has been at the helm of the PRI since 2013 and oversaw some of the biggest years of growth for the organisation. She came to the PRI from the Australian Institute of Superannuation Trustees (AIST) where she spent seven years as Chief Executive Officer. She also serves on a wide array of Boards, including the UN Global Compact and the Steering Committee for Climate Action 100+, the largest ever investor engagement initiative with listed companies. She was recently named as one of the 20 most influential people in ESG investing by Barron’s.

CFM:

For those unfamiliar with the PRI, could you briefly summarise its mandate and objectives?

FR:

The PRI was launched in 2006 by Kofi Annan, then Secretary General of the United Nations, with the aim of bringing sustainability into capital markets. There was at the time a good recognition that in order to solve sustainability issues, one would need the participation of the finance industry. On behest of the Secretary General, some of the world’s largest and most important asset owners came together in drafting what became the six principles for responsible investment, with the aim to bring about the integration of ESG factors, of being active owners, and of being transparent – disclosing how a firm goes about accounting for, and implementing responsible investment. Once the principles were drafted, the question was how to put them into action, leading to the PRI Secretariat being born.

CFM:

We recently joined the ranks of PRI signatories. What is the latest signatory count?

FR:

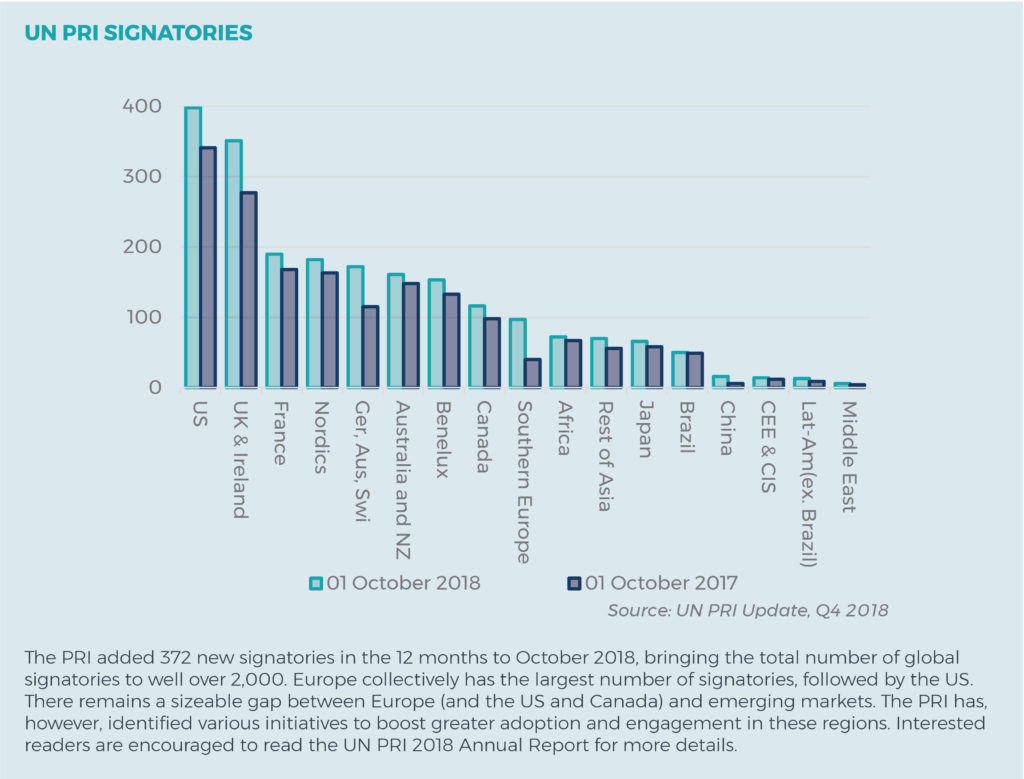

Although the PRI is only 12 years old, I think the growth of the PRI is really the story of the incredible growth of responsible investment. Starting in 2006 with less than a 100 signatories, then mainly large asset owners, to today, where we’ve got 2,200 signatories who represent about $84 trillion of AUM. In the last two years, surprisingly to me, we have had the biggest years of growth ever. As the person who runs the PRI, I’m always thinking that every year we would have reached a saturation point – growing, but much slower. However, every year has seen bigger growth.

And I think the reason is that responsible investment is now, I wouldn’t say it is fully in the mainstream, but it is becoming more than only being seen as a fringe concept. I just came back from the G20 in Argentina and responsible investment was something that was talked about by finance ministers, and by leaders of very large financial institutions in a way that it wasn’t a few years ago. The momentum has been led by a group of committed asset owners who have been pushing for their managers to integrate ESG factors, along with sophistication in the topic that is being added all the time.

Most of these asset owners typically started thinking about how to integrate ESG into their equity portfolios, as were an overwhelming majority of asset managers that initially became signatories. I think there has been a longer tradition in the equity space because in some ways it’s simpler. You can vote your shares, and you can directly engage with the management of companies etc. But, a shift is underway in trying to understand how to integrate ESG across all asset classes. And, now, the key test becomes: how do you incorporate ESG factors in a systematic fashion into every area of your investment activity. That is the journey we are on and still figuring out.

CFM:

There remains, despite the impressive growth of the PRI, and ESG investment commanding plenty of headlines, many hold-outs. What do you consider as some of the key barriers to further growth and interest in ESG investment?

FR:

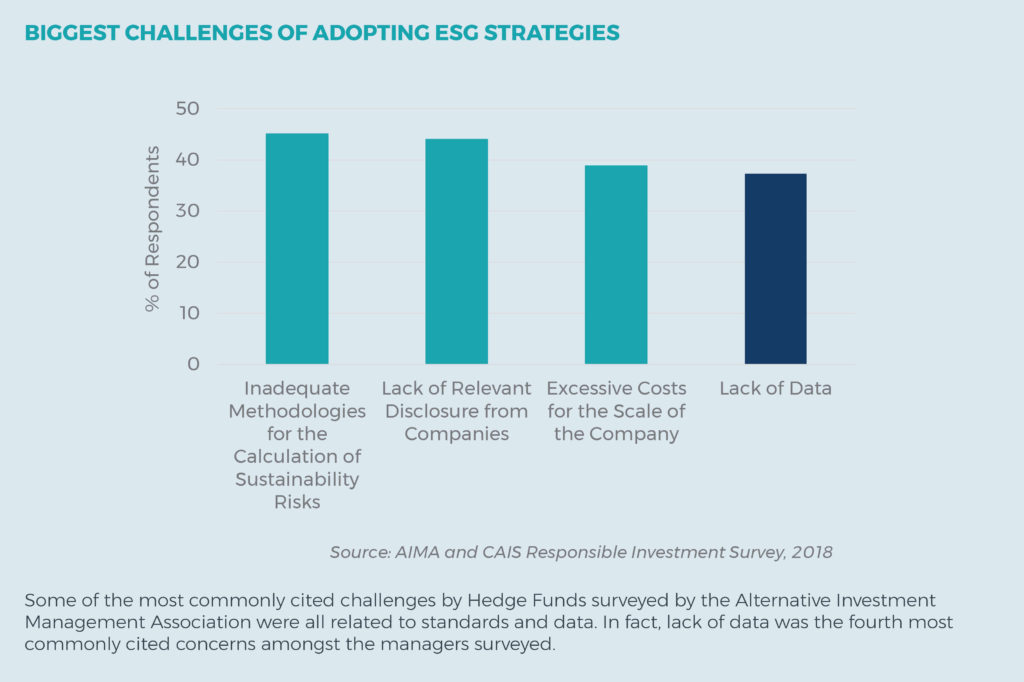

Data. The quandary facing many managers is how to get good data in a measurable, and comparable way. The other key issue is standards. In addressing this, the EU commission, for example, is releasing a draft taxonomy, and I think having a common language, and a set of common standards, is going to help in cementing a common goal in the industry, and, should accordingly facilitate a move to improve data.

We have always taken the view that responsible investing is a big tent, and we are a big tent organisation. There isn’t necessarily only one way to go about responsible investment – different asset owners might have different priorities, as do different countries, along with different regulations. And, for those reasons, the PRI is in essence a principle-based organisation, so that different entities can adapt to their own priorities. For us it is important that firms come to the table, and get involved in any way for which their structure and objectives would allow.

CFM:

Launched in 2017, the PRI “Blueprint for Responsible Investment” identified increased accountability as a key focus area for the PRI. This led to the adoption of more stringent checks and balances for signatories. What was the reason behind the move? And, do you have any concerns that this new policy might discourage firms from becoming signatories?

FR:

When the PRI was launched in 2006, no one was doing responsible investment. Firms may have had SRI (Socially Responsible Investing) funds, but responsible investment had not entered the mainstream discussion yet. It would have been very difficult to measure and set accountability back then. The idea was to get everyone started, but, 10 years on, there were much more expertise in the area, with many more providers and experts that could help firms to address the question of responsible investment. So it was time to say: if you are not really doing much by now, it is because you are probably not committed to doing it.

We have plenty of resources – working groups, case studies, along with plenty of other organisations that provide support and guidance. It was important, and timely to take another step in order to ensure real action is being taken by our signatories. But we were very conscious when we brought into effect our minimum requirements, of not to setting the bar to high.

While some of our signatories felt the minimum requirements were actually not high enough, there is no point asking everyone to run, if some can’t yet walk. New entrants would then feel unable to come into the market. We didn’t want to dissuade firms, especially firms in emerging markets. We will continue to review our minimum standards, and they’ll probably increase over time. In some ways, without regulating – because we are not a regulator – with the introduction of our minimum standards we are trying to drive real change across the industry.

CFM:

This is a parallel question, since there are many firms that are vocal, well-resourced, and have all the best intentions to follow their conviction in accounting for ESG information in their investment process. Others, meanwhile, may have signed up only to tick a box on an RFP, and do very little else. Are you worried that many in the industry might also be marketing products, void of any real and meaningful ESG incorporation?

FR:

That is a difficult thing for us. And I think it is difficult to measure accurately. There are many asset owners with many different views, with many different ESG approaches. Some might have screening requirements. Some of these might be for religious reasons for instance, or based on their membership base. Pension funds in the health sector do not want to invest in tobacco for example. Others will invest in tobacco though.

Amongst all these competing strategies, nevertheless, we take a view of integration, despite negative screening playing a particular role for certain asset owners. We believe, if you really want to make a difference, ultimately, integration is the way of achieving long term change. And, I think responsible investment is about affecting change.

CFM:

You mentioned religion as one possible issue that could justify a screening policy. Some might disagree that this is a valid reason for screening. In ESG, there is often this clash of normative convictions. Do you foresee this divergence in convictions to narrow in the future?

FR:

I think clients will always have different requirements. As we were talking about tobacco and also engagement, many of our signatories would question the point of engaging with tobacco companies. Since they will argue that there is very little that we can ask them to change. They ultimately produce tobacco. With a big energy company, however, when talking about climate issues, one is able to engage and talk about the strategy of the firm in terms of transitioning to a low carbon economy. There are differences, but much less so when talking about core issue such as climate change where I think convergence is inevitable.

CFM:

ESG already encompasses quite a long list of topics. Flipping through your quarterly update, I noticed cybersecurity as one issue in which the PRI is engaged. There seems to be an ever growing list of topics that are being bundled into ESG. What are the limits of issues that could be listed under ESG?

FR:

The world changes so quickly today. Twenty years ago, you needn’t have worried that much about cybersecurity, but now it is a real issue. Looking, for example, only at the privacy issues amongst tech companies and platforms, and the hacking that has happened in major organisations. It has become a fundamental problem. Yes, the list is indeed getting longer, and I think some investors will realise that they can’t tackle every issue. Asset owners are likely to work with their managers, deciding to focus, for example, on a set of five issues for any particular period. Because, unless you are a huge organisation, with a huge amount of resources, it gets difficult to focus on a limitless set of issues.

The world is a pretty messy place at the moment, and I think if you look around the world what is happening in the US and recently in Paris with the ‘gilets jaunes’, if you look at Brexit, all these problems are a symptom of the fact that people feel that the economic and financial systems don’t work for them. That is works for the few, instead of the many. People see that CEOs are still getting paid huge remuneration packages, people see that company xyz is not paying any tax in this or that country. Many are asking what their government is doing in response. I really think responsible investing is what the world needs in response because it addresses such a wide array of issues. Most of the institutional money that is managed is people’s pension money. And they don’t want to see it invested in a way that does them harm. Profit is a good thing, but as long as it is done in a way that creates value for all. I am not sure that a pension fund should only be thinking about your retirement money, without thinking about the world into which you retire.

CFM:

There is evidence, notwithstanding the balance towards positive results, that ESG does not necessarily enhance returns, i.e. cannot be regarded as an alpha factor. All things being equal, should it make sense that asset owners look towards asset managers that provide an ESG offering even if that could mean lower returns?

FR:

It probably depends on your time horizon. If you’re an asset owner that manages liabilities over a very long time period, I can’t see, that over the long term, if one fails to consider ESG factors that one will be able to continue in producing excess returns compared to those who do. When we talk about academic evidence, we are only, at this stage, looking back 8 to 10 years, so I think it is hard to think that if asset managers are able to produce excess returns by not taking ESG into account that this will continue. If a manager continues, for example, to invest in coal or similar fossil fuels, at the moment they might be making good returns, but, if they stick to that conviction, and still do it in 10 to 15 years’ time, then managers might be doing less well. But, if an asset manager has very short-term strategies, you might be less concerned. Our membership is largely as such very much focussed on long term investing.

CFM:

This, let’s call it the time horizon misalignment, is seemingly one of the core flashpoints of ESG investing. Do you think this is partly why some hedge funds and funds with short-term strategies have not been at the forefront of ESG? Do you think this will change?

FR:

Yes. When my team proposed to start a hedge fund working group, I was very sceptical. But, there were many large asset owners investing in hedge funds, who wanted to continue to invest in hedge funds. They came to us with the view that some hedge funds want to get involved and my team and I decided to establish a working group. We probably won’t bring all hedge funds over the line, but from our perspective if we have a couple of hedge funds that are more engaged and are doing more research in this space, we are happier. We take the long term view, and I have been pleasantly surprised to see a small dedicated group of hedge funds that are committed to improving their investment practices.

CFM:

Many (if not most) managers rely to some extent on third party data providers for ESG ratings and research. Is the PRI engaged with the data service providers, and does the PRI have any view on how the hitherto questionable integrity of ESG data, may be improved?

FR:

Data is a major focus or us. Ten years ago, the biggest hurdle for responsible investment was a mind-set: ESG issues were not investment related issues, and were considered as policy issues for governments and the like. When the mind-set shifted, the next big hurdle became a claim that it is against one’s fiduciary duty to consider ESG issues. Now, the biggest single hurdle is data and standards. We decided that driving meaningful data was, as laid out in our blueprint, one of the nine key areas of focus.

Plenty of our signatories think data is a barrier and PRI can probably act as an honest broker. Our interest is getting more traction in responsible investing, we don’t sell a product or data, but we are getting together a group of stakeholders in order to fill the gaps in some of the data. It is a multi-year project, and we are working towards getting standardised, comparable data that is an investment friendly form. We believe the Task Force on Climate-related Financial Disclosures (TCFD) has provided a good framework and believe it could be used as a template in other areas. Our hope is to bring the industry together, acknowledge the problem, and ask how best to solve it.

CFM:

Would the PRI advocate for some form of regulatory oversight for sustainable reporting and data?

FR:

Yes. We would need it. And in some countries that is already happening, where regulators are requiring enhanced forms of reporting. We do work with regulators and certain governmental organisations and we have been heavily involved with the EU Action plan and ‘HLEG’, the High Level Expert Group on sustainable finance that is working its way through the EU commission. Within the PRI we have a policy and regulatory team, along with senior staff that engage with, and act on behalf of our signatories when regulatory topics are being discussed.

CFM:

What, from the perspective of the PRI, do you think is the most pressing issue in the next couple of years for the industry?

FR:

Most definitely climate change. Not to say that other issues we discussed today are any less important, but the time horizon to address climate-related concerns are getting shorter and shorter. We published a paper in September this year before the IPCC (Intergovernmental Panel on Climate Change) was published, reiterating the consensus that global warming needs to be limited to 1.5°c of pre-industrial warming. The Paris agreement calls for a limit of 2.0°c. But, at the current trajectory, the world is set to warm by over 3.4°c. It would spell utter disaster if the world warms beyond 3.4°c in terms of physical risks brought about by natural disasters. In our view, not enough is being done to address these risks and not enough action is being taken. We hold the view that if action is not ratcheted up to address these issues, by 2025 governments are likely to enact extreme measures, and that those measures are likely to have a severe impact on investment markets.

CFM:

What would be your wish list for asset managers in order to address climate change?

FR:

Act now. Or we are going to suffer later. We all live in this world, and as investors we don’t have the luxury of going into a bubble thinking our actions will have no effect. No matter what type of investment manager you are, you need to be thinking of climate resilience, and question the nature of your portfolio. You need to be thinking what are likely changes in the climate going to mean for my investments? How are the companies that I’m invested in making the transition to a low or zero carbon environment, and do the companies have the skills on their board to navigate these challenges? Ultimately, investors and policy makers need to think about how we invest in the energy of the future, and not the energy of the past.

CFM:

What other elements do you deem most important in fighting climate change and boosting further ESG growth?

FR:

More stability from governments. For strategic, long term investment, it is crucial that you know what policies governments might enact if you want, for instance, to move from high carbon to low carbon investment. It is very challenging for long term investors if they cannot trust the longevity of government policy. A change of government is often accompanied by a change in climate-related, or renewable energy policy. How can you be a serious long term investor under such conditions? One needs stable government, with clear intent and I think investors have a role to play in getting the policy settings right.

CFM:

When you leave your office for the final time, what would you consider a successful tenure at the PRI?

FR:

If we don’t have to use the words responsible investment anymore. That all investment is done in a responsible way, and all investment is done considering ESG factors. Most organisations, like ours, should ultimately set out with a mind-set of, if I do my job properly, I won’t be needed anymore.

DISCLAIMER

The text is an edited transcript of an interview with ms. Reynolds on December 3, 2018 at the office of the pri in London. The views and opinions expressed in this interview are those of the pri and may not necessarily reflect the official policy or position of either CFMor any of its affiliates. The information provided herein is general information only and does not constitute investment or other advice. Any statements regarding market events, future events or other similar statements constitute only subjective views, are based upon expectations or beliefs, involve inherent risks and uncertainties and should therefore not be relied on. Future evidence and actual results could differ materially from those set forth, contemplated by or underlying these statements. In light of these risks and uncertainties, there can be no assurance that these statements are or will prove to be accurate or complete in any way. For more information on the pri and how to access a large cache of research, please look around on their website www.unpri.org.